Human-Centred Experience Design / Fintech Experience Design

Human-Centred Experience Design

Investing Ethically

PROJECT OVERVIEW

In 2024, financial markets exist in the context of a new economy driven by service-based businesses, cloud-based and Artificial Intelligence (AI) technologies, product innovations, as well as growing environmental concerns. (1)

Global warming and unsustainable practices have been long recognised as a threat to the planet and all living organisms on Earth. World-wide, there has been a slow but steady transition into a circular economy, one where "resources are never abandoned to become waste. (2)

Everyday, new businesses emerge with sustainability principles at the core of its operations and offerings. However, starting a business is a financial endeavor that requires not only a viable and marketable idea, but also sustained capital.

“Customers perceive real advantages from investing in line with their values, including issues of climate, the environment and people, alongside a financial return.”

Integrating practices that respect the environment, the people who inhabit the land and our connections to the living world represents one of the core values in Te Ao Māori (Māori worldview) (4). These shared indigenous worldwide values are concepts many global economies are increasingly re-discovering and turning to.

Project overview simplified for conciseness.

HYPOTHESIS

Connecting ethical businesses with investors with strong values provides mutual opportunities for financial growth and wellbeing.

THE PROBLEM

How might we enable individuals with strong values to grow personal wealth by investing in innovative, ethical businesses with high profitability?

STAKEHOLDERS MAP

The stakeholders map identifies the people who can influence the design project and the relationships between them. Mapping the relevant people allows to improve the stakeholder engagement and focus on relationship-building with important partners within the organisation during the design process.

DESIGN PROJECT

The design of an investing platform that provides first-time investors access to the stock market. It empowers users to make independent financial decisions by supporting their learning and providing investing options in ethical, innovative and profitable businesses, exclusively.

-

The demand for ethical businesses increases year on year, offering opportunities to innovate in products and services.

Other similar platforms are not exclusively ethically.

Financial education is not a core service of most investing platforms.

Emerging personal finance platforms are innovating in this space, but are not many.

The experience often is distant, corporate, cold and unwelcoming to new investors.

KiwiSaver providers have the majority of the market, but it serves a different purpose.

-

First-time investors

Learning platform (user-driven/no brokers)

Investing platform

Community support

Invest in ethical businesses (values-driven)

Make a profit (profit-driven)

Need to validate business practice (proof/transparency)

-

Investing is complicated, overwhelming, uses legal and financial jargon, and has many hoops to go through.

Building effective financial literacy and competency can be challenging.

First-time investors usually need financial advice or brokers to manage their investment.

There are companies that provide ethical investing, but the access to entry is quite steep for the average person (NZD 500,000).

Finding companies that trustfully reflect investors values is hard.

IDEAL CUSTOMER

Young professionals (Millennials and Gen Z workforce) with new disposable incomes, looking for opportunities to grow personal wealth to achieve specific financial goals:

Tech-savvy, first-time investors finding investing complicated.

They have KiwiSaver providers, but want to explore options to diversify their portfolios.

They want to gain a sense of control and transparency of where their money is going.

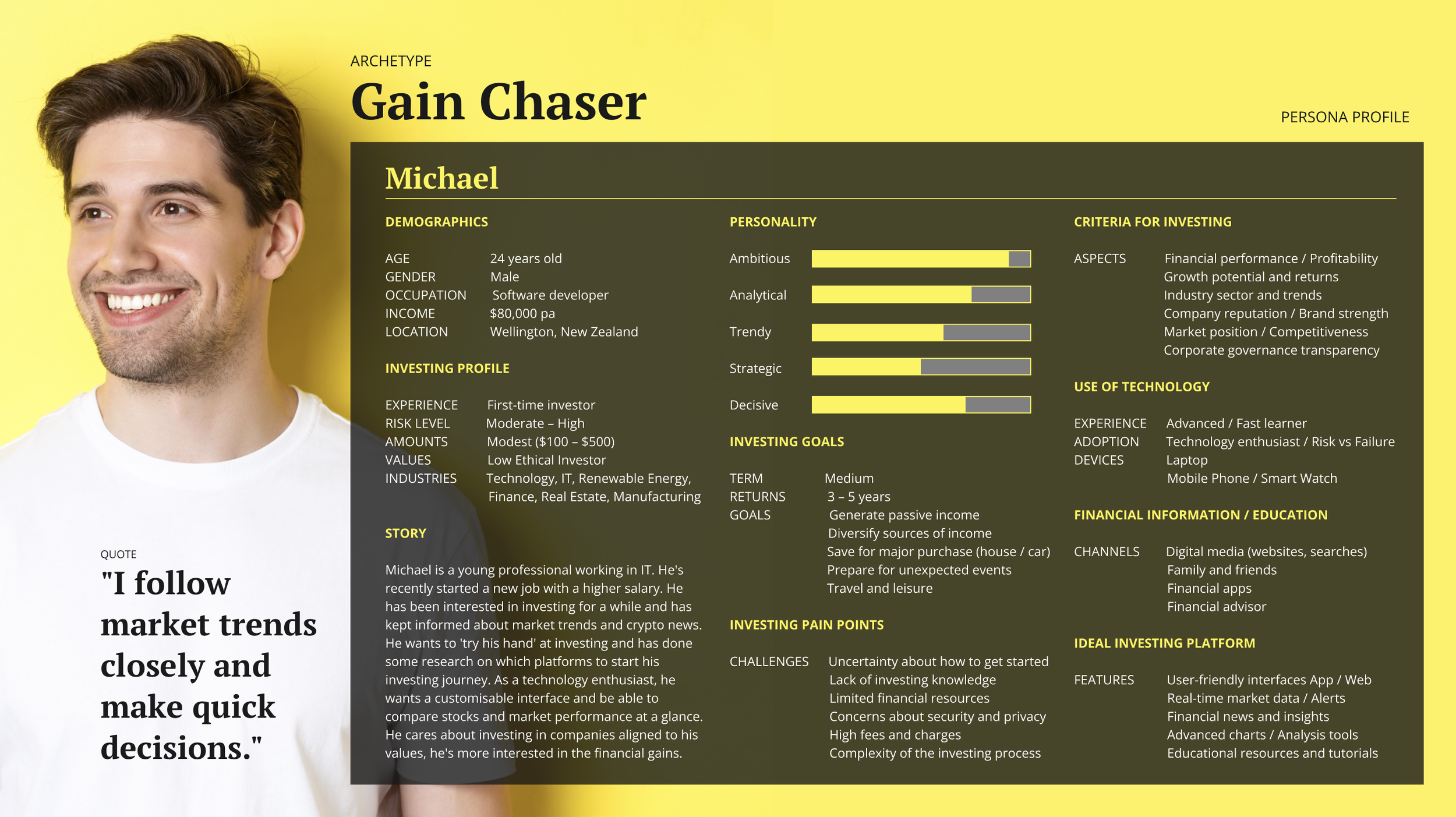

Archetype profile outlining the what matters for this customer profile in this service.

Archetype profile outlining the what matters for this customer profile in this service.

What do they value?

Family’s future and having a long-term, safety financial plan.

Personal wealth growth while supporting ethical businesses.

Intuitive technology and non-intrusive Artificial Intelligence assistance.

Why do they love this service? Why do they keep coming back?

It’s the go to investing platform specialised in ethical investing, where all companies have been vetoed against ethical business performance best practice and have provided transparency reports.

What primary need does the service meet? Are there other needs being met as well?

Primary: Connecting investors to ethical businesses to invest their money and grow personal wealth. Secondary: Educational resource for first-time investor.

SURVEYS & EXPERT INTERVIEWS

As part of the insight generation process for this project, I conducted a survey and interviewed experts in the area of sustainable finance and sustainable business.

SURVEY DEMOGRAPHICS

EMPATHY MAPS

The Empathy Map consists of four quadrants. The four quadrants reflect four key traits, which the user demonstrated or possessed during the observation or research stage. The four quadrants refer to what the user: Said, Did, Thought, and Felt.

Empathy Map – Thoughtful Planner.

Empathy Map – Gain Chaser.

THE MOMENTS OF THE CUSTOMER JOURNEY

The following customer journey map outlines the different moments the investor goes through as they experience the investing platform.

MOMENTS THAT MATTER

The most meaningful moments have been highlighted in the map above and further detailed below. Each of these moments represents an opportunity to deliver a unique experience and solve a problem the investor has encountered in the past in a way that makes them empowered and confident in their investments.

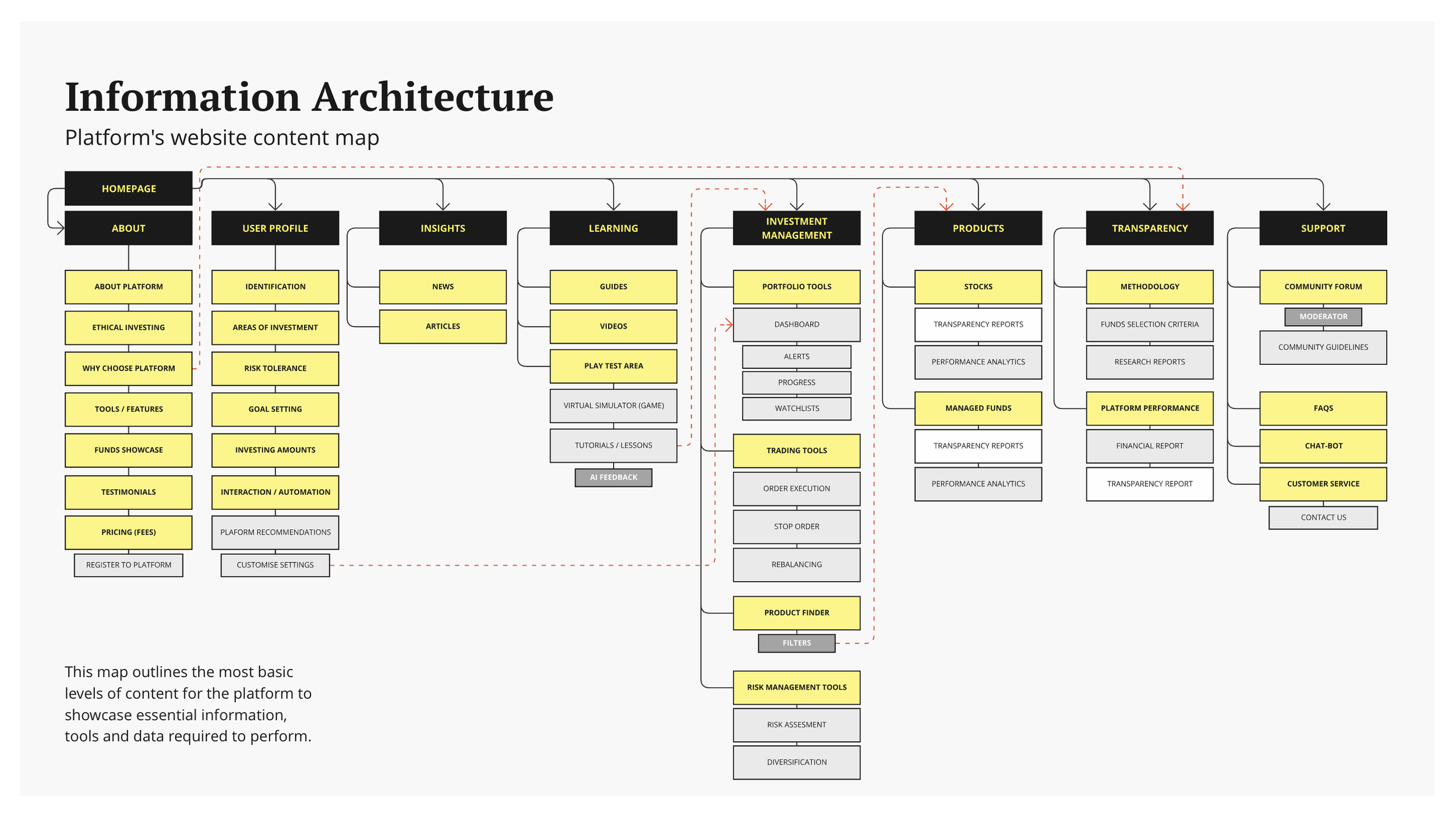

PLATFORM INFORMATION ARCHITECTURE

This map outlines the levels of content for the platform to showcase essential information, tools and data required to perform.

USER STORY MAPPING

A Visual framework used in product development to organise and prioritise features, tasks, or user stories based on the user's journey and goals. It helps teams understand the product from the user's perspective and ensures alignment between business objectives and user needs.

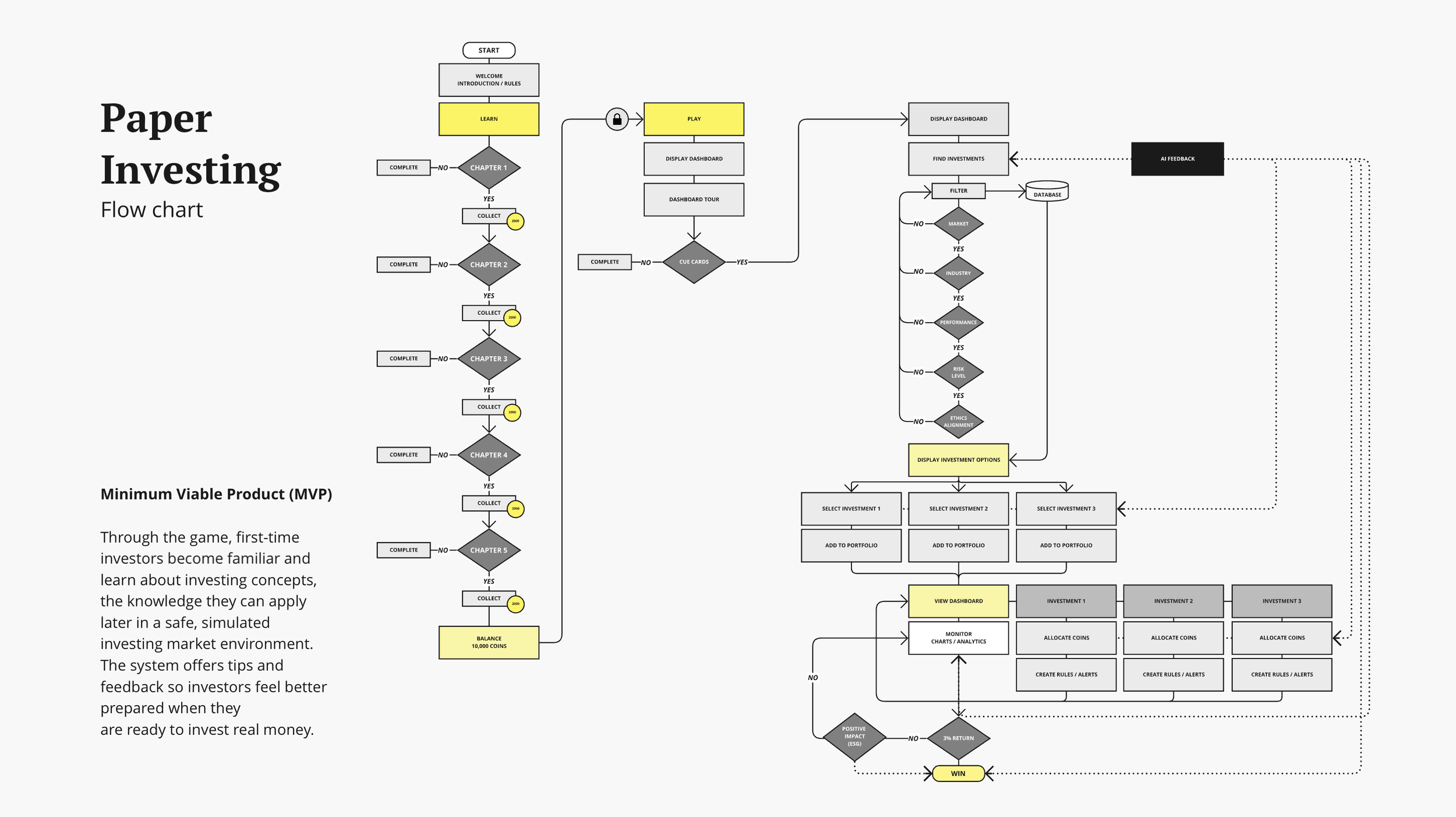

User story map. 3 out of 3. Based on the “Learning by playing” moment that matters.

MINIMUM VIABLE PRODUCT (MVP)

Through the paper investing experience, first-time investors become familiar and learn about the investing concepts in a simulated and safe investing market environment. They will later apply that knowledge when using the platform. The system offers tips and feedback so investors feel better prepared when they are ready to invest real money.

WIREFRAMES

I explore the content and layout for the “Learn by playing” experience based of the flow chart above. This process helped me make decisions in terms of the type of content and visuals that can support the experience. Each image shows a level of refinement in the design process.

USER TESTING FEEDBACK

-

The paper wireframes were the first time that the platform was tested with users. The feedback on these is summarised here:

The experience was limited. The prototype didn't offer much functionality so a lot of the experience happened in the mind of the user. Some users were better about using the imagination, some got a bit lost.

An unfinished product opened the conversation for what type of functionalities could be incorporated and how it could work. The user had some agency contributing with ideas and felt heard about it.

Some suggestions included frameworks for the platform (such as the process for scoring ethical businesses and presenting this information) more than actual functionality of the app.

The paper wireframes required more detailed text and representation of the design elements so the users would understand what they are looking at.

The experience was slow and a bit uneventful as there are no real-time functionality response in the prototype.

-

Low resolution wireframes

Using low resolution wireframes in a digital platform (Figma) became a valuable tool when testing the app as they provided the user with a closer experience to the real product. Some finding are summarised here:

The first iteration of the low resolution digital wireframe was slightly impractical. There weren't many functions to test, only a few worked.

The users questioned some design elements such as the use of dots to represent progression in the test was questioned as the user thought it represented 'pages' or 'images' that needed to be scrolled sideways as the look of the featured was similar to the one used in photo galleries in other apps. This function was replaced with progress bars to make it more effective at communicating the progress the user is making as they go completing answers to the quiz.

-

As the digital prototypes became more refined, the introduction of a branded colour (green) began to interfere with the semiotic of the experience. Users were confusing the use of colour green with the performance of the investment, as the same colour had been use for both. This was corrected in the following iterations by replacing green for a more neutral colour (yellow) so that it prompted action but wouldn't confuse users for other meanings. The brand colour needs to be revised to prevent this from happening in the final product.

The main dashboard offered some functionality and the users were less motivated to edit the dashboard as originally thought or was said in the surveys.

With more refined prototypes, the user testing also became more effective. However, as not all the functionalities of the app were finalised, it also created some roadblocks in certain tasks.

Many task could only be completed in a linear way (finding an investment) as that's how it had been designed. A more fully functionally prototype is required for more complex tasks like applying filters and finding results, but the test could still run effectively.

Because of the high level of functionality, some users thought the look and feel of the prototype was the final look of the app.

CONCLUSIONS

Creating an investing platform that focuses on ethical investing exclusively represents an opportunity to close a gap in the market. There is evidence for demand of such a product. However, the market in 2024 is still quite niche. There are signs of financial investing markets prioritising sustainable and ethical business practices and customer demand to make the investing platform a successful offer in the near future.

User experience design is a rich process of multiple iterative stages that requires to constantly reference user research and make the user a living element of the process in order to create a real, valuable and financially viable product experience.

CONCLUSIONS simplified for conciseness.

NEXT STEPS

The development of the Investing Platform mock-up design applying brand elements and optimising the user interface (UI) for an intuitive experience will be created as separate branding and UI projects.

REFERENCES

(1) Claus, I. and Smith, C. (2022). What’s the ‘New Economy’? And has it crossed the Pacific to New Zealand? Retrieved on 16 July 2024 from RESERVE BANK OF NEW ZEALAND: Bulletin Vol 63, No. 3. https://www.rbnz.govt.nz/-/media/1b040c594f8c4792a85b68638ff7b4be.ashx?sc_lang=en

(2) Sustainable Business Network (2020) Designing out Waste. What is a Circular Economy? Retrieved on 16 July 2024 from https://sustainable.org.nz/learn/designing-out-waste/

(3) Stephenson, F. (2024) Predictions for sustainable business in 2024. (2024) Ingrid Cronin Knight – Chief Growth and Sustainability Officer, Waste Management. Retrieved on 16 July 2024 from https://sustainable.org.nz/learn/news-insights/predictions-for-sustainable-business-in-2024/

(4) Mindful Money (2024). Voices of Aotearoa: Demand for Ethical Investment in New Zealand 2024 Report. Retrieved on 3 August 2024 from

https://mindfulmoney.nz/media/news/file/2024/07/29/embargoed-final-consumer-study-2024-nz.pdf

(5) Investopedia (2004). Impact Investing. Retrieved on 16 July 2024 from https://investopedia.com/terms/i/impact-investing.asp

(6) Understanding Te Taiao (2024). Retrieved on 19 July 2024 from https://www.taiaoora.nz/te-taiao

(7) Investec Wealth & Investment (UK) (2023). Gender differences between men and women when it comes to investing. Retrieved on 7 August 2024 from

(8) Dam, R. F. and Teo, Y. S. (2024). Empathy Map – Why and How to Use It. Interaction Design Foundation - IxDF. https://www.interaction-design.org/literature/article/empathy-map-why-and-how-to-use-it

(9) UXtweak (2024). What are user scenarios in UX. https://www.interaction-design.org/literature/article/empathy-map-why-and-how-to-use-it